Article II 6/2024 - WHAT DOES IT TAKE TO DEVELOP A SUCCESSFUL AND SUSTAINABLE AQUACULTURE INDUSTRY?

And yes: aquaculture production will increase. The question is where? What species? Which technologies?

Many countries want to develop a successful and sustainable aquaculture industry. But what does it take in terms of planning, regulations, inputs from the authorities and investor know-how?

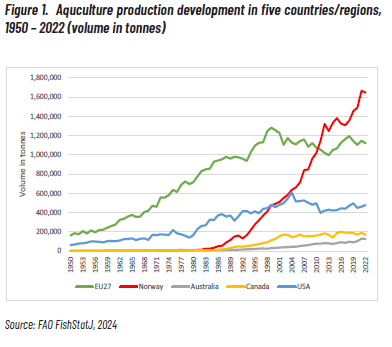

In order to get some answers to these questions, I chose five countries or regions which have gone through different experiences: one very successful country (Norway); one where things have come to a standstill (the European Union); one that is just in the early stages of development (Australia); and two countries with a lot of potential but with meagre results so far: the United States and Canada.

I looked at the ways in which they differ, and how these differences may explain the success, or lack thereof. Further, I decided to look at just a few, but important characteristics of the aquaculture industry in these regions:

- What species do they focus on? How many species?

- How are the natural conditions for aquaculture in the country or region?

- Is the legislation and regulatory framework in place? How developed is it? Is it being enforced?

- What is the technological level of aquaculture in the region? What technologies have been chosen?

Aquaculture industry development up to 2022

Aquaculture growth in the EU was quite steady from 1950 through the 1990s; after the turn of the millennium, there was stagnation and decline.

Norway had no production at all until the late 1960s or even into the early 1980s, but then it took off and although there have been ups and downs, the trend continues to be one of strong growth.

Australia had a production of less than 10 000 tonnes until the early 2000s, and it is only in the past twenty years that there has been any significant growth. However, Australia is still in the early stages of aquaculture development.

The industry in the United States grew until the early 2000s, after which it went into decline. This was mainly because of a stagnation in the channel catfish industry. Growth has picked up a little again, but overall, remains relatively level. The same goes for Canada. There was modest growth from about 1990 until about 2005. Since then, production has been rather flat.

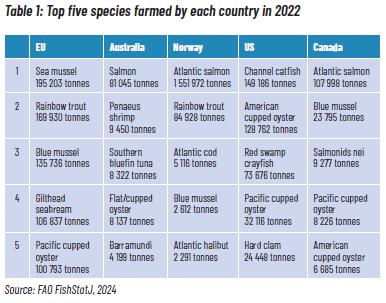

The choice of species

In the EU, slightly over 400 species are cultured. In Australia, 39 species are grown, both warmwater and coldwater species. In Norway, only 16 species are grown, all of them coldwater species. One species alone – salmon – accounts for 94 percent of the total production volume. In the US, the number of species is limited to 41, while Canada, with only 19 species, is more in line with Norway.

Australia is concentrating mainly on salmon, which is grown in the south (Tasmania), but there is also a growing production of oysters, barramundi and shrimp further north, in temperate to tropical waters.

In North America (the US and Canada), shellfish (oysters, mussels and clams) are an important culture group. But finfish is also important; from the early days of the 1980s until about 2002, good growth has been seen in the US with channel catfish (Ictalurus punctatus), and in Canada, with Atlantic salmon (Salmo salar).

The great difference between salmon and channel catfish is that salmon is a truly international commodity, while channel catfish is a mainly domestic commodity. Salmon prices follow international trends, which are affected by a wide range of countries, while prices for channel catfish are mainly influenced by developments on the US market.

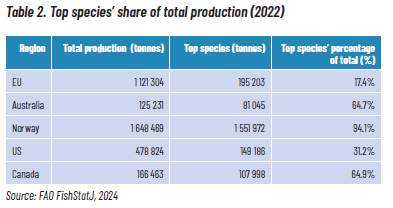

Looking at how much of the region’s total aquaculture production the very top species account for, we see some interesting differences (Table 2).

- The top species in the EU (sea mussels) accounted for only 17.4 percent of the total production (in terms of volume).

- In Australia, the top species (Atlantic salmon) accounted for 64.7 percent of the total production volume.

- In the US, the top species (channel catfish) accounted for 31.2 percent of the total, while in Canada, salmon alone stood for almost 65 percent of the total production.

- In Norway, the top species (Atlantic salmon) accounted for 94.1 percent of the total production volume.

However, there is also something to be said for having several species; for instance, the risk can be distributed over several species. If the market for one species declines, you can shift to another one with better market prospects. It would therefore be useful to know what the main emerging species in global aquaculture are.

The geographical differences

There is no doubt that Norway has very good natural conditions for marine aquaculture: a long coast that offers plenty of protected areas where fish farming can be done. The rest of Europe does not have this in great measure, with a few exceptions. Scotland, for example, has similar coastlines and has indeed been able to develop salmon farming of an important magnitude.

Four countries dominate the production of aquaculture species in the European Union: Spain, France, Italy and Greece. Together, these four countries accounted for 67 percent of the total EU aquaculture production in 2022. Of the four countries, only Greece has large marine areas that are well protected by islands and inlets along the coast to any significant extent.

Across the Atlantic, both Canada and the United States have coasts with protected areas like in Norway. The United States also has temperate waters in the south, and both countries have large freshwater resources that are not fully utilised for aquaculture.

The regulatory framework

Representatives of the Norwegian aquaculture industry and governmental authorities have cooperated in the formulation of the regulatory regime on aquaculture. Right from the start, the emphasis was on a regulatory framework that enabled investors to operate sensibly. Since 1973, Norway has developed and fine-tuned the regulatory framework for fish farming as new challenges and needs have been identified, and the country has also been able to assist other countries in developing their aquaculture laws and regulations.

The Norwegian regulatory framework can be characterised as enabling.

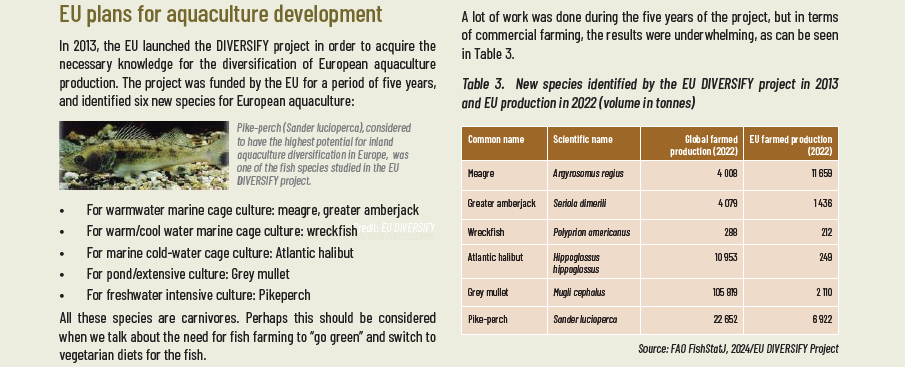

The EU aquaculture industry seems weighed down by a bureaucratic approach to development. In the new strategic guidelines adopted in 2021, the focus is on environmental protection, human and animal health, building resilience and competitiveness (but not saying anything about how to do this), “the green transition”, social acceptance, increasing knowledge and innovation.

The European Union is more oriented towards legalities in relation to the industry’s relationships with the environment, rather than the needs of the industry. In other words, the EU aquaculture policy is on the whole, a typical bureaucratic document that is more concerned with regulations and considerations than with developing an industry. It appears to be an endless collection of words with very little relevance to aquaculture development.

The EU regulatory framework can be characterised as seeking control.

The Australian regulatory framework is a mess, varying from State to State. What is promoted in one State may be forbidden in another. There is a great need for a coordinated legal and regulatory framework.

The Australian regulatory framework can be characterised as confused.

The United States has been characterised by fierce in-fighting between various special-interest groups. American politicians (and authorities) seem dangerously ignorant about the aquaculture industry and are totally focused on re-election. Consequently, they are controlled by opinion polls and the voices that cry the loudest, like environmental groups and antiaquaculture groups. The result is that much of the scientific basis for creating an industry is disregarded (or remain unknown).

The US regulatory framework can be characterised as dominated by lobbying.

In Canada, it seems that the Government is not overly interested in developing the aquaculture sector. The latest example was when the Fisheries Minister Diane Lebouthillier announced a ban on open-cage pen salmon farming in British Columbia effective 30 June 2029. This decision appears to be influenced more by arguments from aquacultureunfriendly special interest groups than on scientific evidence.

The Canadian regulatory framework can be characterised as limited and confused.

The use of technology

- Dams are quite common and in fact, probably the most-used technology. Dam culture requires land and access to good water supplies. Dams are used for freshwater fish culture, shrimp culture, etc.

- Rope culture is used mainly in marine environments for mussel or oyster culture.

- Floating cages were introduced with salmon farming and are today used for a number of marine fish, like trout, seabass, seabream, and cobia, but also for some freshwater species like tilapia, pangasius and carp.

- Land-based fish farming is popular at the moment. It requires rather heavy investments, good water supply, and land areas close to the market. However, land-based operations have had a number of teething problems, and have proven difficult to be profitable so far. Land-based aquaculture has become particularly popular in urban areas, and a lot of investment has gone into land-based salmon farming, for example in the United States. But so far, it has not been a great success. It has run up against a number of “unforeseen” problems, which in fact may be just the result of inadequate planning. In the United States, particularly, there are numerous regulatory hurdles as well as an apathy in the financial sector, and the authorities seem unable (or unwilling) to do anything about creating an enabling environment for either landbased aquaculture, or indeed for any aquaculture at all.

- Offshore installations are huge floating cages very much like floating oil exploration platforms. Investments are enormous, and they are placed far out from the coast to avoid pollution and parasite attacks. There are a few in operation already, and they would be suitable for areas without a protected coastline (like southwestern Africa).

But technology is a very complex term. Aquaculture technology today includes factors like biology, marine architecture, communications, surveillance and monitoring technologies, automation, nutrition, feed production technology, feeding procedures, disease treatment and handling of parasites.

Consequently, the fish farmer must be aware of all of these technologies and how they interact and can be used. This is not an easy task. Technology is developed for a reason, usually to achieve improvement of some sort, such as better feeds, reduced production costs and prevention of disease. Technological improvement requires research, and research costs money and heavy investments.

Conclusion

First of all, a legal and regulatory framework is needed to set the rules as well as objectives when it comes to how we want this sector to develop. The regulations must not only aim at achieving economic success, but they must also include environmental considerations so that the activity can continue in perpetuity.

Laws and regulations are not good for anything if they are not enforced. Therefore, we need the means to enforce the law.

In the management of resources, we need solid scientific knowledge on which to base decisions, which can be obtained from research programmes. Without research and development, the industry would stagnate.

A national industry does not operate in a vacuum. Resources and challenges are shared with neighbouring countries, and therefore we also need international cooperation in order to solve these problems.

In order to achieve economic success, aquaculture farms must be operated efficiently. This also means that we need to have full utilisation of the biomass; the waste should be as little as possible; and every ounce of biomass should be used for some profitable purpose.

Education is crucial to the operation of the industry and the further development of it.

And lastly: we need to produce for the market, and to make sure that what the market wants is what the market gets.