Article II 6/2024 - INNOVATIONS ALONG THE SEAFOOD TRADE AND VALUE CHAINS: THE WAY FORWARD

Meanwhile, the 36th session of the FAO Committee on Fisheries (COFI) which was held this past July, underscored the importance of sustainable fisheries and aquaculture in meeting current and future food security and sustainable growth needs, while achieving sustainable and resilient agrifood systems. COFI36 also welcomed global initiatives to promote sustainable aquatic foods from marine and inland waters, including by addressing food loss and waste. The Session strongly supported Blue Transformation as a Programme Priority Area and adopted the Guidelines for Sustainable Aquaculture (GSA), while requesting for FAO’s technical assistance and support for their implementation.2

2 FAO. 2024. The State of World Fisheries and Aquaculture 2024 – Blue Transformation in action. Rome. https://doi.org/10.4060/cd0683en

Global seafood trade outlook5

Global fish production, encompassing both capture fisheries and aquaculture, is anticipated to rise from 185 million tonnes during the base period to 206 million tonnes by 2033. Global fish production is expected to expand by 12% (or 22 million tonnes) over the next decade compared with 21% (or 32 million tonnes) during the previous decade. Aquaculture will drive the deceleration of growth, while still maintaining its role as the primary force for the overall expansion of global fish production. By 2033, aquaculture is expected to account for 55% of global fish production, compared with a share of 51% during the base period.

4 FAO. 2022. Blue Transformation – Roadmap 2022–2030: A vision for FAO’s work on aquatic food systems. Rome. https://doi.org/10.4060/cc0459en

5 OECD-FAO Agricultural Outlook 2024-2033OECD/FAO (2024), OECD-FAO Agricultural Outlook 2024-2033, OECD Publishing, Paris/FAO, Rome. https://doi.org/10.1787/4c5d2cfb-en.

Trends in utilisation and processing of seafood products

In 2022, of the 165 million tonnes destined for human consumption, live, fresh or chilled accounted for about 43%. This continues to represent the preferred and most high-priced form of aquatic food products, followed by frozen (35%), prepared and preserved (12%) and cured (10%). Freezing is the main method of preserving aquatic foods, accounting for 62% of the 93 million tonnes of processed aquatic animal production for human consumption (i.e. excluding live, fresh or chilled). Significant differences exist in the utilisation and processing methods across continents, regions and countries, and even within countries. Preservation and processing may vary due to differences between species related to their characteristics, composition, size and shape. Aquatic species can be prepared using a wide range of methods, from manual to fully-automated. An industrialised fishery often has different processing requirements from a small-scale artisanal fishery. Products can be packaged and commercialised in a wide variety of ways depending on the location, scale of operation, country’s infrastructure and market demand.

FAO Trade Policy Briefs. No. 52, Lem et al., 20236, provided three key messages: i) aquatic products are among the most widely-traded food items worldwide; (ii) trade of aquatic products significantly contributes to economic growth in the developing countries; and (iii) small-scale fisheries (SSF) have a big contribution to the national economy.

- Diversify markets, including evaluating opportunities in neighbouring countries, to mitigate the adverse effects of eventual shocks and disruptions that affect trade.

- Increase awareness about the nutritional and macronutrient benefits of aquatic products as an affordable and easily accessible animal protein.

- Implement knowledge-sharing actions to facilitate the market access of the small-scale fisheries sector (SSF) to international markets.

Importance of innovations along the seafood trade and value chains

- Ensure more Public-Private Partnerships (PPPs) to attract investments and drive technological developments;

- Build awareness on the nutritional and macronutrient benefits of fishery products, and increase access to affordable and accessible animal protein;

- Improve access to markets and sustainable fish trade;

- Improve end-to-end cool chain management and distribution systems;

- Promote compliance, traceability and seafood safety issues;

- Reduce Food Loss and Waste (FLW) along the seafood value chains while promoting a circular economy; and

- Encourage considerations on environmental, social and aquatic animal welfare issues.

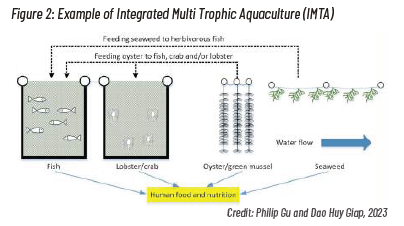

- Boost production through integration of different trophic levels;

- Generate employment and improve livelihoods;

- Bridge the gaps between standard-setting, trade and technology;

- Reduce competition among land, water and energy use while promoting energy-efficient and alternative use of resources;

- Lessen the burden of water, spaces and labour utilisation;

- Develop a competitive, transparent and integrated value chain;

and - Address social and environmental issues including climate change, fish and crustacean welfare etc.

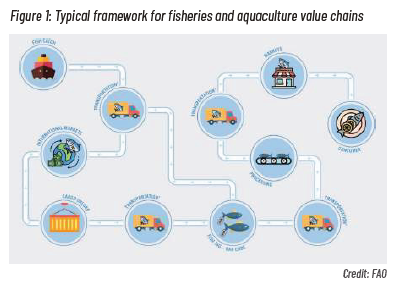

The following ways (a-j) should be explored along the seafood value chains to improve trade and economic returns; gain better market access; strengthen traceability and standard-setting; and build awareness among the key stakeholders.

8 Blaha, F., Vincent, A. & Piedrahita, Y. 2023. Guidance document: Advancing end-to-end traceability – Critical tracking events and key data elements along capture fisheries and aquaculture value chains. Rome, FAO. https://doi.org/10.4060/cc5484en

9 FAO. 2022d. Report of the regional consultations on advancing end-to-end traceability in fish value chains – Virtual meetings, September 2021 to January 2022. FAO Fisheries and Aquaculture Report, No. 1378. Rome. https://doi.org/10.4060/cc0307en

The combination and integration of different trophic levels such as Low Trophic Aquaculture and Integrated Multi Trophic Aquaculture (Figure 2); species (fish, shellfish and seaweed, etc.) or nature-based solutions; the introduction of land-water-energy efficient farming techniques (combined recirculating aquaculture systems and biofloc, offshore farming and aquaponics, etc.); and utilisation of solar power and locallyavailable resources (aquasilviculture, permaculture, etc.) might contribute to production which is not harmful to nature. Nature-based farming of aquatic animals not only provides value through ecosystem benefits such as carbon sequestration and nutrient absorption; but it also adds value to the total aquaculture production. At the same time, development of climate-resilient and disease-resistant seeds; and alternative sources of animal protein and group certification will strengthen the sustainability of the aquatic producing and growing systems.

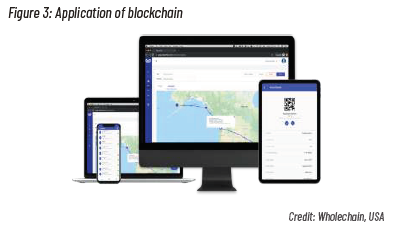

b) Smarter supply chain management using blockchain

With the help of blockchain technology, customers can source seafood products, and trace and track their origin. It ensures that supply chains of aquatic food systems are more traceable and responsible.

c) Responsible value chain management using AI and ML

There are some good examples of the application of Artificial Intelligence (AI) and Machine Learning (ML) along seafood value chains to ensure transparency and accountability. These include technology for species identification (e.g. FishFace); quality inspection of tuna (e.g. TunaScope); electronic monitoring of fishing activity (e.g. SnapIT) in fisheries; counting sea lice and monitoring salmon growth (e.g. AquaByte); counting shrimp PL and predicting growth (e.g. XpertSea); and improving farm management and productivity (e.g. Aquaconnect).

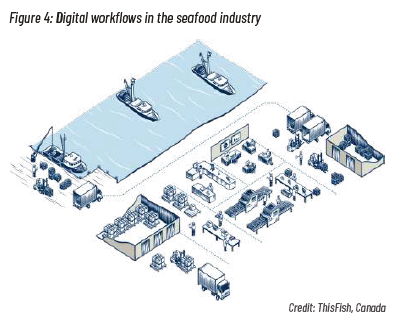

- Most companies recognise that digitisation is inevitable (Figure 4), but some are slow to change. As AI is about extracting more value from existing data, it could help drive digitisation in the seafood industry by boosting the return on investment;

- Seafood has more natural variability than most food commodities. Species, fish size, seasonality, sexual maturity, catch method and storage time: all these factors affect quality and yields. As a result, it is often hard to accurately predict production and quality outcomes. That is a perfect problem for machine learning, whose core strength is its ability to take an incomprehensible number of variables to accurately make predictions; and

- For AI to work, you need clean, comprehensive and complete data. False or inaccurate data will undermine AI’s ability to make good predictions. AI motivates companies to ensure that their suppliers are sending them accurate data, thus improving supply chain traceability. Technologies such as blockchain don’t solve the “garbage-in, garbage-out” data dilemma. AI does.

11 How is Artificial Intelligence going to disrupt the seafood industry? Eric Enno Tamm, 2020. Post in LinkedIn. https://www.linkedin.com/pulse/how-artificial-intelligence-goingdisrupt- seafood-industry-tamm?utm_source=share&utm_medium=member_android&utm_ campaign=share_via

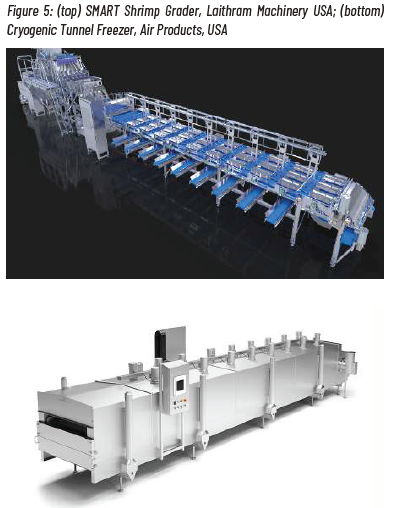

Handling and processing of seafood products is multifaceted and diversified. The equipment and supplies (examples in Figure 5) used to process products depend on the following considerations: (i) types of species; (ii) variety of products; (iii) targeted market; (iv) production volume; (v) manpower and time; (vi) access to finance; (vii) willingness to adopt change; and (viii) customer demand. Furthermore, there are also variations along the key handling and processing steps, such as farm to processing plant; and processing plant to consumers.

Value-addition and product diversification are two sides of the same coin, and we must diversify our exports by the addition of newer species through aquaculture. There is an increasing need for safe and healthy seafood products with high sensory quality (Gonçalves, 2011)13. However, the taste, texture and flavour of seafood; and the attitude, beliefs, behaviour and traditions of consumers are also important to penetrate a new market. Dependency on certain markets does not benefit the economy in the long term, as was demonstrated during the COVID-19 pandemic period. Hence, improving domestic markets; and enabling market access and diversification of markets are the key for sustainable seafood business.

Access to developed markets requires product certification by national regulatory agencies. It is worth thinking about a small-producer aquaculture standard in the form of a national certification standard which could be similar to, but less rigorous than, VietG.A.P. 14

14 Melissa, M. and Ann, W., 2014. Is certification a viable option for small producer fish farmers in the global south? Insights from Vietnam, Marine Policy Volume 50, Part A, December 2014, Pages 197-206. https://doi.org/10.1016/j.marpol.2014.06.010

Consumers are increasingly aware of the negative impacts of plastic pollution, giving room for growth of bioplastic packaging made from seaweeds and other ocean materials. Nowadays, entrepreneurs prefer responsibly-sourced packaging materials with the ability to provide traceability information on the label (e.g. a QR code).

Innovations are necessary to improve seafood product packaging and labelling (Figure 7). Generally, seafood packaging is done to: (i) prevent moisture leakage; (ii) preserve quality and safety; and (iii) provide traceability information. Over time, the concept of biodegradable and sustainable packaging has gained wider acceptance. Different startup companies are now developing biodegradable packaging made from seaweed and other ocean-sourced materials. These types of packaging are not only useful for nature and people, but also promote the circular economy.

A multitude of hazards (biological, chemical, and environmental) can be introduced into aquaculture throughout the production and supply chain. They can also originate from unsuitable farming practices, environmental pollution, and the socio-cultural practices prevailing in various regions. Ensuring safe, secure, affordable, and quality food for all in a global context is pragmatically difficult. In this context, it is quite imperative to understand the ecology and dynamics of these hazards throughout the entire production chain in a One Health approach.15 Considering public health needs, it is urgent to ensure food safety at the national level while linking it directly to food and nutritional security as well.

Due to increasing seafood demand, the occurrence of food fraud is also rising. To prevent this malpractice, equipment such as the Micro-X-ray fluorescence (ITRAX) appears to be a useful tool.16

16 Patrcia. S.G, Karthik, G., Jesmond, Samut., Neil, S., Jagoda, C., Debashish, M., 2018. Itrax micro X-ray fluorescence (μXRF) for soft biological tissues. Methods X, Volume 5, p1267-1271 . https:// methods-x.com/article/S2215-0161(18)30157-2/fulltext

Entrepreneurs and startup companies can enhance consumer awareness by disseminating information on the health benefits of regular consumption of seafood through social media like Facebook, TikTok, X, Instagram and LinkedIn etc. Social media plays a vital role in reaching a huge customer base within a short time. On the other hand, the application of various mobile apps by food delivery service providers (Grab, Food Panda, etc.) added a new avenue for SMEs in e-commerce; this is one of the best examples of demand-oriented marketing in the seafood sector.

i) Minimise food loss and waste and maximise socio-environmental benefits

Utilisation of seafood by-products and co-products {fish scales, fish maws, fish skins, crustacean shells, fish meal and fish oil, fish protein hydrolysate (FPH), pituitary glands, collagen, gelatin, chitosan, pet food, biofertilizer, handicrafts made from fish scales and mollusc shells, etc.} also offers significant social and environmental benefits along with the economic value. By utilising these fishery by-products and co-products, the seafood industry can directly contribute to SDGs by reducing environmental hazards and increasing economic benefits through circular economy.

j) The following policies are being highlighted below to ensure inclusive and sustainable development along the seafood trade and value chains:

j.1.) At national level (producers, suppliers, traders and consumers)

- Promote ‘cluster-based farming’ among small-scale producers to reduce competition for water, space and energy, and to grow shared responsibility;

- Improve end-to-end cool chain management by enabling sufficient and affordable handling, transport, preservation facilities to ensure farm-to-fork distribution;

- Harness innovative technologies (such as IoTs, AI, Machine Learning and blockchain etc) to improve transparency and responsibility along the seafood value chains;

- Introduce improved processing and freezing techniques; and alternative packaging to ensure quality and safety of the seafood products; and

- Create widespread awareness that it is essential to grow an adequate amount of responsible seafood rather than produce a huge amount of seafood by following an unsustainable approach.

- Regional and international coordination and collaboration are required to ease market access and trade barriers;

- Public-Private-Partnerships are required for consistent funding in the research and development of new technologies and innovative approaches;

- Capacity-building programs through training and piloting appropriate technologies are required to transfer cost-effective innovations in the small-scale sector;

- Benchmarking and governance are needed for the sustainability of the fisheries and aquaculture-related technologies; and

- There should be a common platform to update and share the relevant information among the key stakeholders.