Article II 6/2024 - CHINA: TOP GLOBAL PRODUCER AND NET IMPORTER OF SHRIMP

In 2023, there was a sudden surge in vannamei shrimp production in the country that crossed one million tonnes, enabled through the greenhouse aquaculture technique. Overall production of the species increased by 8–10% in comparison with 2022. Industry reports indicated a supply of 3.5 million tonnes in 2023, including from local production and imports.

15 years of unbridled growth

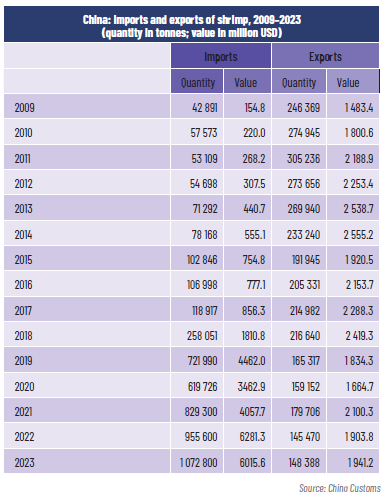

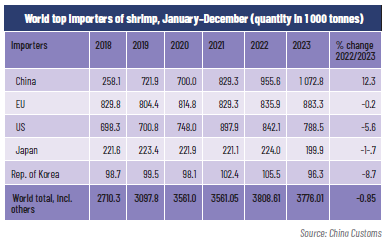

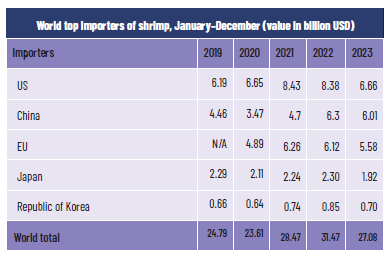

Frozen shrimp imports in China displayed a quantum leap, from 103 000 tonnes in 2015 which had an import value of USD 755 million, to 258 000 tonnes (USD 1.8 billion) in 2018. Imports crossed 700 000 tonnes in 2019, just one year before the COVID-19 pandemic crisis, which made China a net importer of shrimp for the first time and one of the top three importers in the global shrimp trade. With the exception of the 2020 “pandemic year”, shrimp imports have increased every year until 2023 when China broke the world record (and its own record) with an import volume of 1 072 800 tonnes.

Leading shrimp exporters to China

During 2019–2023, Ecuador increased its farmed shrimp (vannamei) exports to China by 116%, reaching almost 700 000 tonnes in 2023 with a 65% share in the total imports. Ecuador is the leading supplier of headon shrimp to China, increasing its exports of the product from 115 000 tonnes in 2020 to 200 000 tonnes in 2023 (+74%). Coldwater shrimp from Canada, Argentina, Greenland, the Russian Federation, Denmark and Norway comprised 10% (86 000 tonnes).

India, the second leading exporter to China, exhibited fluctuating supplies during the last five years.

The rise of greenhouse and RAS culture systems in China

Guo estimated that there are now 250 000 of these ponds, producing 500 000 tonnes of shrimp. Their fairly low cost of about USD 7 000 to build each greenhouse pond, can be paid off within a year if the operators achieve an 80 percent survival rate. However, the downsides of these greenhouse systems are that they occupy a lot of land, use up too much groundwater, and discharge large volumes of wastewater. For these reasons (and also the fact that the aquaculture sector in the country is increasingly being regulated), Guo predicted that more inland industrial indoor recirculating aquaculture system (RAS) farms will be established. He said that although RAS farms contribute only about three percent of the country’s shrimp at present, the largest eight of these farms are producing an impressive 70 000 tonnes of shrimp between them. One of the largest operators is Tongwei (one of the country’s main manufacturers of solar panels), which aims to hit one million tonnes in 5–10 years, according to Guo. Other big names in the sector include Evergreen and CP.

Increased production and imports create oversupply in 2024

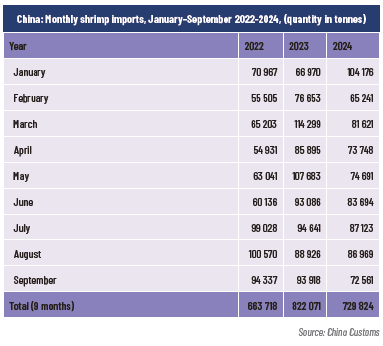

In 2024, imports declined after steady growth for many years. Monthly imports in 2024 increased only in January and remained below 2023 levels during February to September 2024. Cumulative imports during the first three-quarters of 2024 were down by 3.6% year-on-year at 730 000 tonnes. With consumer demand remaining weak to moderate during this period, the domestic market is in an over-supply situation.

Nevertheless, during January–June 2024, China ranked as the number one market in the global shrimp trade, with imports of 483 170 tonnes of shrimp. The United States was the second-biggest market with 351 340 tonnes, followed by the European Union (348 560 tonnes).

With regard to the domestic production of farmed vannamei shrimp, aquaculture industry experts expect growth of only 2% in 2024 at 800 000 tonnes in comparison with 2023, when the growth rate was estimated at 8%.

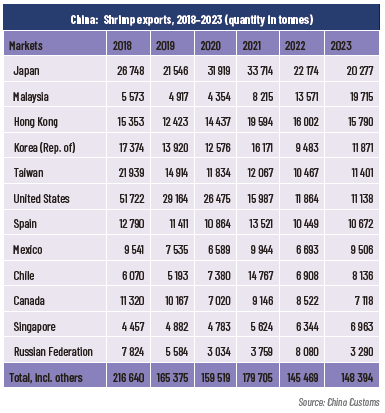

Increased shrimp exports

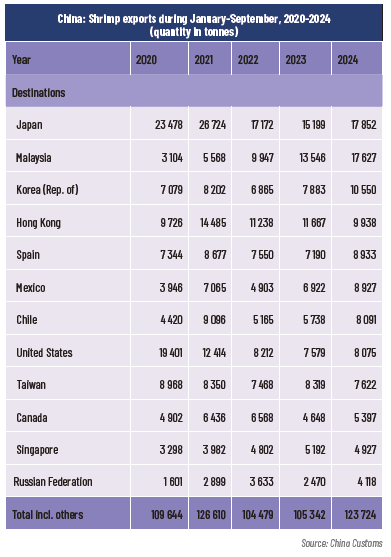

During January–September 2024, Chinese shrimp exports improved to 123 725 tonnes in comparison with 105 342 tonnes and 104 479 tonnes during the same periods in 2023 and 2022 respectively, as a result of increased availability of cheaper raw material through imports. The share of value-added products in the total exports also increased from 61% in 2023 to 64% in 2024. The main markets were Japan, Malaysia, the Republic of Korea, Hong Kong and Spain.

Positive outlook for 2025

Domestically, consumer demand has been active since the third quarter of the year, associated with the mid-autumn festival in September and the week-long National Day celebration in October 2024. Shrimp prices in the distribution chain have started to firm up from the fourth quarter of the year – a trend likely to continue till the Lunar New Year in January/ February 2025.