Article II 5/2024: THE EUROPEAN UNION: CURRENT TUNA PRODUCTION, MARKET AND UPCOMING REGULATORY CHALLENGES

Canned tuna trade and market flows

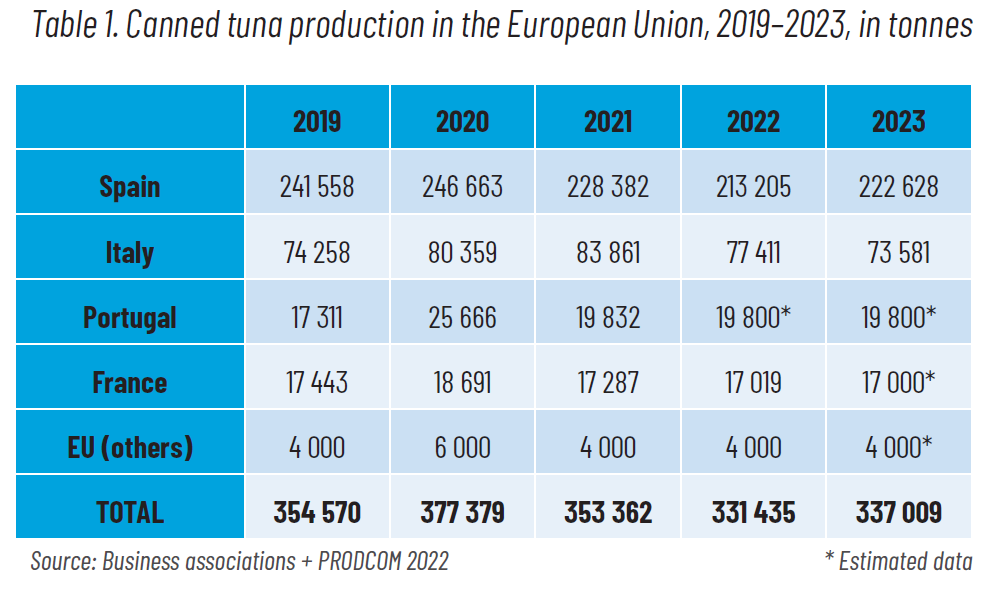

The data for 2023 shows an upward trend of +1.6% compared to 2022, reflecting a recovery following the slowdown suffered as a result of the COVID-19 pandemic. Growth is expected to stabilise in 2024.

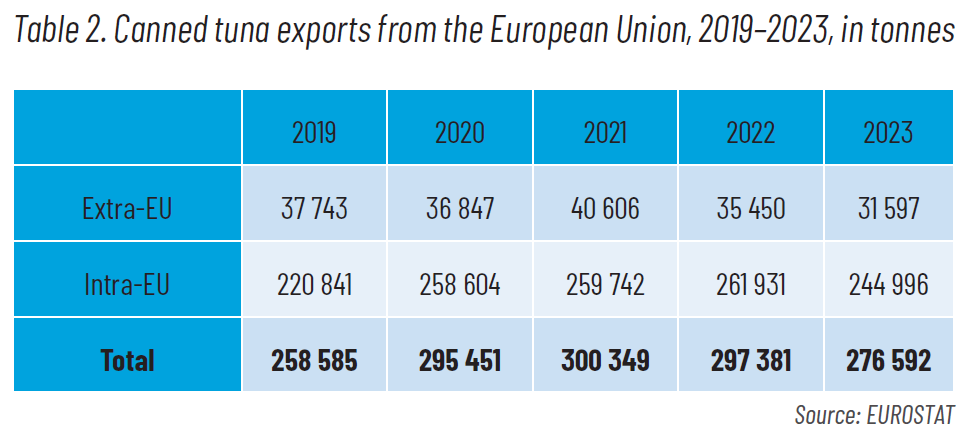

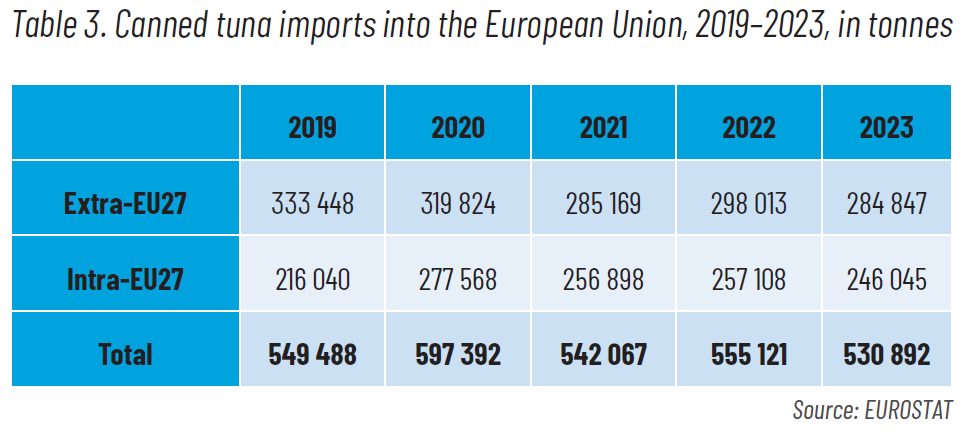

At the same time, domestic consumption of canned tuna in the European Union is affected by inflation (apart from 2020, when apparent consumption exceeded 660 000 tonnes during the pandemic). Thus, for 2022, it was estimated that 589 175 tonnes were bought by consumers, down by 8.7% compared to 2019. European per capita yearly consumption is around 1.3 kg, with a negative projection for 2023, but a recovery is expected in 2024. In terms of the total quality consumed, the main countries continue to be Spain, Italy and France, while Malta has the highest per capita consumption with 3.4 kg/inhabitant/year. In order to satisfy the EU canned tuna market in 2023, this would require more than one million tonnes of whole (round) tuna as raw material.

Frozen/thawed preparations

This new market segment requires approximately 150 000 tonnes of whole (round) tuna per year.

Changes in post-COVID consumption

Let me share a thought. It is clear that a willingness to pay for tuna products means that the consumer perceives that he or she is getting more value than he/she is paying for. And if inflation pushes prices up, strategies must focus on innovation with the aim of further improving the consumer’s perception over the product.

Of all the marketing strategies, tuna has one big ally: health. Precise communication about the health benefits of eating tuna can help to increase consumption in the European Union. Therefore, the global industry must make a collective effort to reinforce messages in this direction, incorporating the importance and benefit, for example, of selenium in its interaction in the diet in the face of exposure to mercury present in tuna; or the need to ingest Omega-3 fatty acids. It is essential to activate public debate, highlighting the positive aspects of eating tuna for health because the growth of the market depends on it, at least in the European Union.

The latest European Market Observatory for fisheries and aquaculture products (EUMOFA) study shows that, in 2022, households in countries such as Italy, Spain and France used more than two-thirds of their total expenditure on meat products. In other words, fish, such as tuna, have the capacity to absorb part of this expenditure with well-targeted promotional strategies, which must also consider the reputational and sustainability aspects. In that sense, there are eco-labelling strategies already put in place, and the EU’s “Green Claims Directive” will help to protect consumers from “greenwashing” practices. The positive message is, there is opportunity to grow if we do it right.

Upcoming legislative changes in Europe

The European Commission in Brussels is therefore exhibiting firm purpose to ensure compliance in creating a level playing field in the European market; and speeding up internal decision-making processes such as the imposition of yellow cards for illegal, unreported and unregulated (IUU) fishing, among others.

But that’s not all: in terms of sanitary standards, changes are coming for the Bisphenol-A (BPA) content in metal packaging; new MOAH (Mineral Oil Aromatic Hydrocarbons) limits will affect the vegetable oils used; and a new European packaging and packaging waste regulation will impose stricter requirements for plastics used as packaging materials.

Finally, a revision is underway of the European Regulation 853/2004 for vessels freezing tuna at -18°C, in terms of new validation requirements, temperature charts and additional traceability requirements.

All these changes should be expected, with the aim of continuous improvement of standards, and better practices.